Today I would like to share what I consider, the most fun strategy to trade that I personally use.

It’s simple, it works, and anyone can do it. Not only that, you can use it on any timeframe, depending on how much time you’d like to spend in front of the charts.

Some people really enjoy spending lots of time on the charts, while others only want to check in only a few times a day to adjust their positions. Regardless of where you are on that spectrum, this strategy can work for you.

Although, on the surface, the strategy is very simple and easy to get started with, I will be diving deeper into the inner workings of why it can work from a market structure perspective.

With that being said…

Let’s start with indicators. There is only 1 indicator that is required, and that is the 200 MA (Moving Average). This is what we consider to be “fair value” for any given currency.

We know prices will always return to their “fair value”, so this is where we want to GET OUT of the market. When price is above/below it’s “fair value”, is where we want to GET IN the market.

So the entry and exit rules are simple:

- If price is above “fair value”, we can sell the asset. We exit our shorts once the market returns to “fair value”.

- If price is below “fair value”, we can buy the asset. We exit our longs once the market returns to “fair value”.

Beyond these core rules, you can season the strategy how you like for specific entries be it using price action, RSI or other indicators. I will share more on my personal seasoning later…

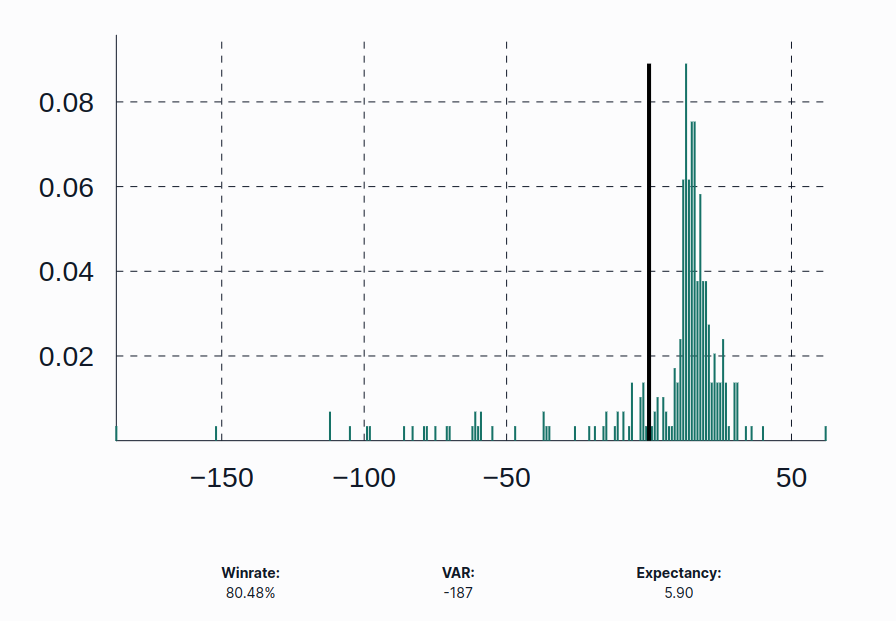

At this point, most of you reading this are probably thinking, “This guy can’t be serious…” But, I can assure you, I am. Below are my own results from trading this strategy on EUR/GBP last month using the 1H chart:

The quick overview is, I have maintained a winrate of about 80%, I made on average 5.9 pips per trade, and my Value At Risk was -187. My median win is about 15 pips, and my median loss was about 20 pips.

And this is how it looks month after month…

There is one caveat to this strategy though… It will only work if you manage your account like it’s a real business that is buying and selling perishable products for profit.

I will dive deep into this later but what it essentially boils down to is this, you need volume to consistently make stable returns. Not volume in size, but volume in deals. This means you must do 2 things:

- Stay Small

- Trade Often

A short example to illustrate the point. Imagine a grocer who is selling tomatoes. Based on current market demand, they estimate they can sell $100 worth of tomatoes over the next week, and for every tomato they sell, they expect to make $1.00. But they have $3000 of cash.

Their expected value of each tomato transaction is $1.00, so mathematically, why not buy $3000 worth?

Even though they could try and buy $3000 of tomatoes to sell over the next week, the probability of $2900 worth of tomatoes going bad is so high, that it would be foolish to buy that much.

The expected value of the first $100 worth of tomatoes is very positive. However, the expected value beyond that point goes straight to -100%, the further you go beyond it, the fast you eat up the gains from the first $100 of tomatoes.

They have to stay small in tomatoes and use their money on other products.

This strategy is the same way. There is only so much you can bet on any single position or leg depending on when you get in the market, if you go over that, you are removing the edge of the system by taking on excess risk that will almost surely not pay off, similar to the extra $2900 worth of tomatoes the grocer could buy.

This would be a kin to planning your risk around the size of your mean or median loss.

Now even though the median loss is very small, you can see the Value At Risk is actually quite large. It’s very important to know this because when you are thinking about your risk, this is the number you need to make all of your decisions around.

If you used the median or even mean loss instead, you will take on excess risk that will almost surely not payoff, resulting in you losing money so fast it will make your head spin. Mainly because you will quickly find yourself way over-leveraged when drawdown inevitably hits.

So when you are planning your risk, assume the risk of every position is the VAR, not what your mean or median loss is. This will keep you small, which will allow you to trade often.

This is enough for the introduction. I will be posting my trades here going forward to provide a live example of how to use the strategy. I will also post deep dives into the areas mentioned above as time permits. This will include things like:

- Hidden Risk

- Estimating the rate of “inventory” perishing.

- Handling the portfolio like a business.

- Theoretical modeling drives the advantage of this strategy.

And more!