One of the most important things a trader can understand is the payoff structure their strategy creates for them. This means the amount of money they stand to make or lose depending on how their trade ends up.

When it comes to payoffs, there are Linear and Non-Linear Payoffs. The one you are likely most familiar with is the Linear Payoff.

Linear Payoffs

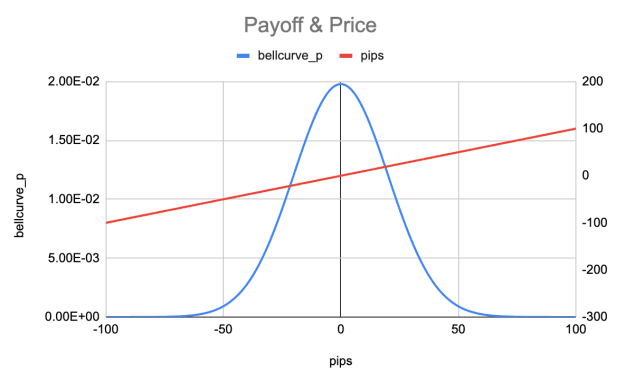

A linear payoff simply means, your profit and losses grow linearly as the price moves up and down. This results in the payoff graphs below:

If you are long, your profits grow at a consistent rate as the price moves up, and they shrink at a consistent rate as the price decreases.

This is the payoff structure your position will have if you maintain the same lot size throughout the position.

Non-Linear Payoffs

The next kind of payoff traders can have is a Non-Linear Payoff. If you are familiar with options, you likely have encountered this payoff structure many times.

If a payoff is non-linear, it simply means that the growth rate of your PnL is not fixed as the price moves around. Depending on the payoff structure, your profits can grow faster as the price moves up than your losses grow as the price moves down.

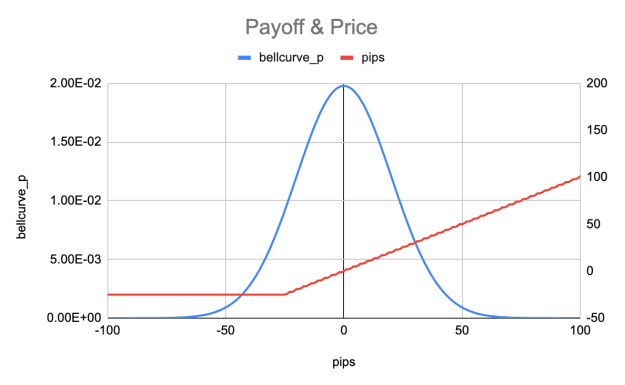

For example, below is a non-linear payoff structure of a call option:

As you can see in the graph below, as the price moves up, our profits will increase linearly BUT as the price moves down, our losses will not increase at the same rate. Once our losses go below -25 pips, they stop growing altogether.

When Is One Payoff Preferred Over the Other

Now in terms of answering the question, which payoff is best? The answer is, it really depends.

If you are trading heavily skewed distribution, linear payoffs can work great. If you are trading a very efficient market with next to 0 skew, a non-linear payoff will likely provide better results than a linear one.

As with all things trading though, when to use one or the other is not a black-and-white solution.