If you have been on any trading forum or looking at any social media related to trading, you must have seen at least 10 “Prop” firm ads by now claiming they fund trades and dole out massive payouts.

At first glance, these seem like a really excellent service. It gives people with little money the opportunity to get “funded” with “real capital” so they can start trading with some size. All they have to do is pay a small tryout fee.

Because the offer of these services sounds really good on paper, these trader funding businesses have exploded over the years taking the internet by storm.

The sad reality is, I have yet to see a more predatory business practice in the forex market and it is my personal opinion that all of these companies are essentially modified Ponzi schemes.

Before I explain why let’s first recap what exactly a Ponzi scheme and multi-level marketing scheme are.

The definition of a Ponzi scheme is “a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors.”

The reason I say it’s a modified version of this is that the clients of these businesses are not investors but instead, candidates looking for funding. That being said, the new money from unsuspecting victims is used to payout the “returns” of the “funded traders” that actually turn a profit if there are any.

Are Funded Traders Really Funded?

In some firms, the funded traders are really funded, but in others, I am not so sure.

These firms will claim that the traders who pass their challenges, will be given real trading capital that they can use to attempt to get payouts whenever they make a profit.

But in their Terms of Service, there is no actual legal definition of what a “live” account is. These firms can set up their own MT4 and MT5 (MetaTrader 4 & 5) servers that show “live accounts” that are actually still trading paper money.

But why would they want to do this you ask? Why would they not want to make real market gains when their funded traders do well?

The answer is, nearly 0% of traders who are funded, actually ever receive a payout. Most of them lose money and eventually bust out of the challenge and need to restart. If they really had to shoulder the losses of these traders, their margins from selling challenge entry fees would shrink dramatically.

Instead, it is much more profitable for them to have the “funded” traders trade against fake books, and for those that do earn a payout, the firm just uses challenge money to send them whatever their payout would be.

This way, any losses incurred by “funded” traders are not actually losses at all. And as a whole, the majority of funded traders do lose money as you will see in our breakdown of one of these firms’ own reported numbers.

Breaking Down One Firms Numbers

I am not going to name exactly which firm this is, but you can bet your bottom dollar that these numbers are similar across all firms.

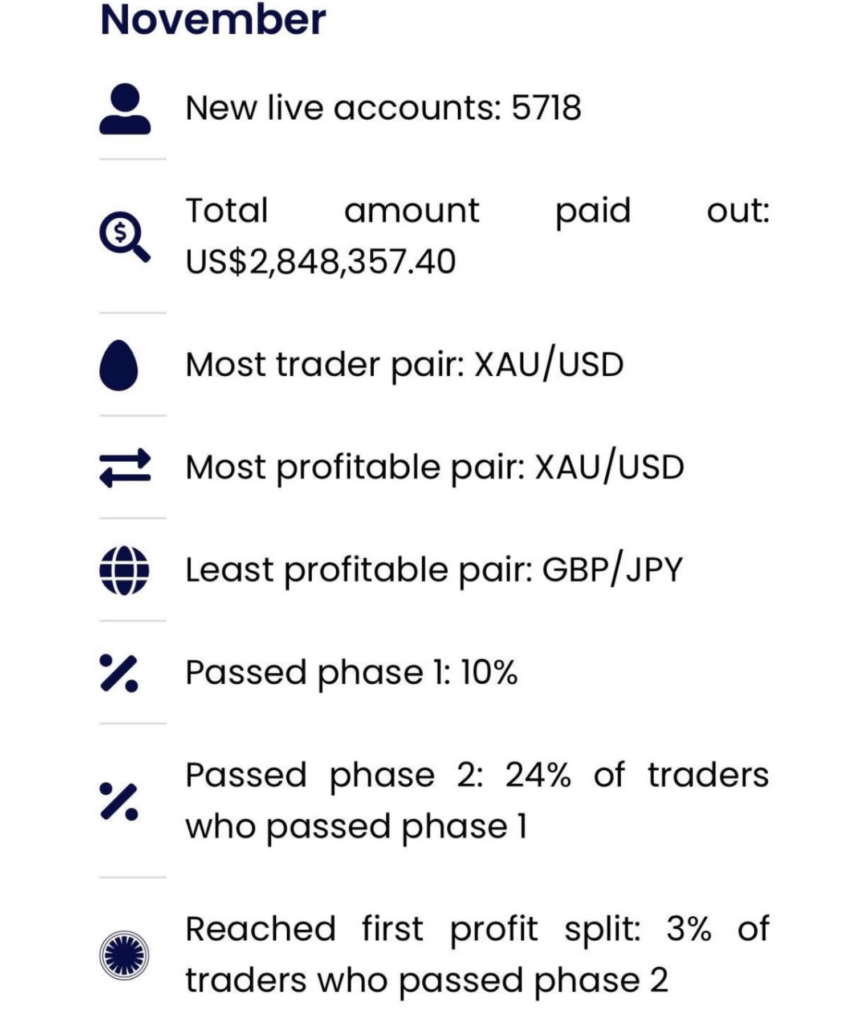

So with that, let’s dive into the breakdown of this firm’s November numbers.

The firm reported that:

- They have 5718 new live accounts or people who paid for a challenge.

- Of these 5718, 10% of them passed the first phase of the challenge, allowing 571 traders to move to phase 2.

- Of that 571, 24% of them passed phase 2. This means 137 moved on to the next stage of the challenge where they could potentially reach a payout.

- Of that 137, only 3% reached their first payout… 97% of traders who pass both phases of the challenge go on to lose money supposedly trading “live accounts”. This means 4 of the 5718 challenges that were taken this month, reach a single payout. That is a success rate of 0.07% from the start of the chain. Keep in mind, that 0.07% chance is the probability of reaching one payout. Reaching the 2nd payout is even smaller than that. Extrapolating with the numbers of those who reach a payout out of those who are funded (3%), I think you can safely assume that only 3% of those who reach 1 payout, reach a second payout.

When I first started looking into the business behind these firms, I knew the numbers would be bad, but I didn’t think they would be this bad. I still honestly can’t even believe this firm posted these numbers.

So now that we see these numbers, it should be painfully obvious why these firms have to use the new money from challenge takers to payout the few “funded” traders that have survived long enough to get a payout.

Let’s model some scenarios to paint this picture more clearly. We will assume every one of those 5718 traders took a $10K trading challenge that had a $100 entry fee.

So to start, the firm received a total of 5718 entries into the challenge at $100 each, providing a total revenue of $571,800.

By the end of the first and second phases, the total amount of “live accounts” funded would be valued at $1,370,000 (137 accounts funded with $10K each).

In the example above, if all 137 of those who received a “funded account” were trading $10,000 accounts, 132 of them would have lost the firm $1000 for a total of $132,000 (roughly 23% of the cash collected from challenges. If they use a fake book, the firm can retain 23% minus the payouts of the 3 profitable traders which dramatically increases their margin).

Of the 3 who made money, the firm usually splits the profits 50/50. This means for the firm to cover the losses of the failed traders, the successful traders would have needed to earn $264,000 between the 3 of them to pay them out and recoup the losses from the 97% of funded traders who failed. This means each of them would have needed to earn an 880% return, just to cover the losses.

The likely hood of this occurring is essentially 0. The losses of the 97% will always eat up any profits from the remaining 3%.

If the firm offers payouts higher than 50/50, the 3 remaining traders would have had to earn even more to have their payouts be paid with actual trading profits, instead of new money coming in by challenge takers.

So with this in mind, let’s think back to the definition of a Ponzi scheme.

Ponzi Scheme: A Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors.

These firms are not direct Ponzi schemes since they are not taking “investors” which is why I call them a “modified Ponzi scheme”, but they are 100% without a doubt, luring traders and paying profits to earlier traders who passed (the slim 0.07%) with the funds of the 99.93% of recent challenge takers.

Conclusion

With all of this, I hope you reconsider taking one of the challenges next time you are thinking of doing one.

If you do decide to take one, remember there is a 99.93% chance you will never receive a single payout, or in other words a 99.93% you lose your entire investment in the challenge.

It is almost a guarantee that you will have better odds of both making money and at a minimum not losing all of your money by trading your own capital directly through a reputable broker.