If you have done any amount of trading at all, one of the first things you quickly learn is, markets are really hard to trade. Sometimes it can literally feel like they are out to get you. “They” being a shadowy broker or big banksters.

You know deep down this almost certainly isn’t what’s responsible for your losses, but it provides a nice scapegoat and might help you sleep better at night.

All jokes aside, it’s important to understand what actually makes markets very hard to trade. There isn’t any one specific thing. In fact, there are at least 100 different things people can think of that play a factor in your performance, and they are all correct to some extent. But in my opinion, there are a few core things that I believe have the most impact on people’s negative performance.

If you can master and understand these core ideas, your probability of successfully trading will drastically increase.

Markets Don’t Really Trend

The first big thing that makes markets really hard is, there is little to no usable directional skew in prices that you can consistently rely on to make profitable traders.

Skew being a degree of asymmetry in the distribution of prices. In layman’s terms, this means a consistent and predictable trend.

One of the first things traders here is, “the trend is your friend” but in reality, there really aren’t constantly predictable trends you can befriend. This advice is not wrong, in fact, it’s right, but the advice is misguided because it implies consistent trends exist and is easy to find.

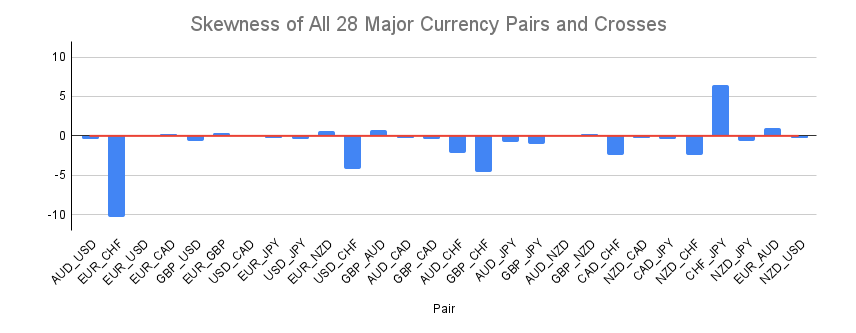

But if you take an overview of prices and measure them for skewness using any relatively large sample size, you will see there is no significant skew in any of the 28 major currency pairs and crosses.

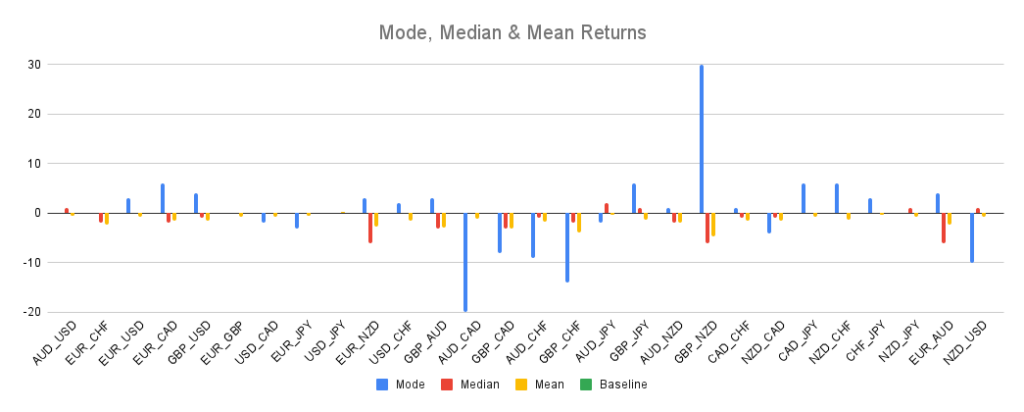

In fact, for nearly every pair, the amount of detectable skew in price (in pips) is not even 25% of the average spread on the pair. So even if these were real trends, they are not large enough to overcome the transaction cost of the spread. There are a couple of pairs with what appears to be 10 or so pips of skewness but if you couple the skew data with the mean, median, and mode of each pair, it only re-affirms that in terms of price movement, there is no consistent trend.

This means that if you build a system around the idea of forecasting price direction, you will almost surely fail to consistently make profits.

Fixed Binary Outcomes Only Work In Strong Trends

The next thing that makes trading difficult for both new and seasoned traders alike, is the love of binary trading outcomes or payoffs.

Specifically, the idea of risking 100 pips to make 100 pips and holding the trade till either your stop loss or take profit is hit.

These kinds of trading strategies are very appealing because intuitively, they feel like a good idea and simplify your trading in general as it basically becomes “set it and forget it”.

The problem is, because there is no consistent trend or skew in any price distinctions that is significant enough to take advantage of, any strategy with this type of fixed binary outcome will not work.

A strategy with this kind of fixed binary outcome could only work if there was a clear and consistent skew in prices that is significantly larger than the spread of the market plus any additional trading costs and slippage.

In nearly all markets, your trading strategy needs to allow for more possible outcomes than 2 possible outcomes or payoffs.

Relative Trading Costs Are Higher Than Most Think

Another reason trading is often really hard for new traders is, they are trying to trade in ranges that are just too tight to allow you any chance of being profitable. This can be exacerbated if you also use fixed binary outcomes outlined above.

The issue with tight ranges isn’t because they are too small in isolation, the issue is, they are too small in relation to spread and other trading costs.

When it comes to trading, your biggest enemy is your transaction costs. The reason this is the case is, your transaction cost is almost certainly one of the biggest things that are preventing you from being profitable.

This is because the size of your transaction cost, in relation to the range you are trying to trade, creates the minimum edge you will need in order to simply break even on any one trade. And if you trade ranges that are too small, this minimum required edge becomes so large, it’s impossible to overcome.

To calculate the minimum edge required to break even, you need to do the following:

- Normalize average transaction cost per trade into a pip/point value (Example: 2 pips). Thankfully with most Forex Brokers, the only transaction cost is the spread itself, so this step is already done.

- Calculate the average size of your winners into a pip/point value (Example: 10 pips).

- Calculate the average size of your losers into a pip/point value (Example: 10 pips).

- Divide the normalized transaction cost by the sum of your average winner and loser (Example: 2 / (10 + 10) = 0.1 or 10%). This decimal number is the minimum edge your system needs in order to break even.

In the simple example above, if you are using a 10 pip stop loss and a 10 pip take profit and the pair you are trading has a 2 pip spread, you will need at least a 10% edge in order to break even using that setup. This means your win rate needs to be at least 60%, instead of the expected 50% that comes with a 1:1 risk:reward ratio setup.

And if you review the first section about how much markets really trend in one direction or another, the skew in pips or as a % of the trading range is almost always only a fraction of 10%.

So for nearly every pair, using a tight range is setting yourself up for failure.

If you widen your range though so that the spread is a much smaller ratio when compared to the range, your minimum edge required to break even becomes much smaller. For example, if you used a 100 pip stop loss and a 100 pip take profit, the minimum required edge to break even shrinks down to only 1% instead of 10%.

Conclusion

Now that we’ve covered in a bit of detail the three main reasons I personally think markets are so hard to trade, I hope it has shown some light on why you may be having terrible results with your trading. If you are doing or not accounting for any of these 3 things in your trading strategy, there is a really high probability that you are struggling.

If you are trying to predict trends, trading with fixed binary outcomes, and or using take profits and stop losses that produce really small ranges, you have about a 0% chance of surviving in the market long term.

The main thing about the market that drives all of these 3 issues is how it’s structured in terms of fees and the fact that the market is essentially completely random and efficient. Now I want to be clear though, just because something is random, does not mean it’s impossible to profitable trade it. It just means you need to understand what you are speculating on, and how to take advantage of its characteristics.

There is a huge difference between something being random and being normal. Markets are random but they are not normal. In fact, they are far from normal, and this is where opportunity exists to make money.